Don’t be one of those people who has massive stockpiles of prepping gear but lives paycheck to paycheck with high credit card debt and no emergency or retirement savings.

Being prepared means lowering your chances of bad situations happening and being ready to handle them when they do. Being a rational prepper means preparing based on which emergencies you’re most likely to face.

Even though it’s easy to think about zombie fantasies, you’re much more likely to face personal financial hardship than a huge SHTF collapse event, where cash is worthless and you’re bartering bullets for bread.

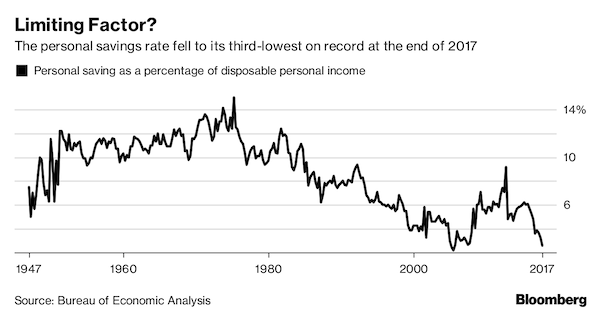

Personal economic hardship, and a general sense of things going in the wrong direction (both personal and at a larger economic level), represent two of the biggest reasons why people are preppers. Money is usually the #1 or #2 most popular answer given when researchers ask people what causes them the most pain in life.

Some shocking facts about America, “the wealthiest country in the world”:

- 43% of American families — that’s 51 million households — struggle to afford a reasonable level of housing and food.

- 14% live in poverty. 20% of children go hungry for at least a portion of the year.

- 57% have less than $1,000 in savings.

- 25% have a significant life-disrupting financial hardship per year.

- 46% can’t afford to handle an unexpected $400 emergency (like a sudden car repair) without using their credit card. 61% can’t afford a $1,000 expense. Yet 33% of households have a major unplanned expense per year.

- 77% of Americans don’t have enough saved up to cover six months of expenses. 26% have $0 in emergency savings.

- The average 35-65 year old American is $125,000 in debt.

- The average American with a credit card balance carries $16,000 in debt at a 17% interest rate.

- 2016 college graduates have an average of $37,000 in student loans.

- 25 million people per year choose not to get medical help or take important medications because they can’t afford it. 620,000 people per year declare bankruptcy due to medical expenses.

- Over 50% have $0 in retirement savings, and the median is only $5,000. Only 18% of people feel confident they have enough saved for retirement.

- Millennials have a nest egg 30% smaller than all previously-recorded generations at the same age.

- About 35% of millennials have $0 saved for retirement and 20% say they will never retire.

- Even though it might seem like the economy is doing well, over 80% of the gains go to the wealthiest 1%. The vast majority of normal people haven’t seen any real economic improvement in decades.

Things are only going to get worse. There is almost no data that suggests things will get better for people outside the top 1-5%. Future changes like automation and job loss combined with changing demographics will only accelerate the problem.

Money troubles have a huge impact on your life: stress, bankruptcy, divorce, depression, physical and mental health problems, poor work performance, your children are disadvantaged, and on it goes. Perpetually living hand-to-mouth, or digging yourself out of a debt hole, is just a horrible experience.

Be prepared. Don’t be a victim.

Want more great content and giveaways? Sign up for The Prepared’s free newsletter and get the best prepping content straight to your inbox. 1-2 emails a month, 0% spam.

From a prepping perspective, financial problems increase your risk of emergencies and reduce your ability to handle them because you have fewer options and resources.

A minor medical problem such as a toothache can turn into a full-blown emergency when you’re faced with a choice between getting the treatment you need versus paying your car loan so you can still drive to your must-keep job. But then it snowballs into a larger problem: root canals are more expensive than a cavity filling, you miss more work or get fired, then you can’t pay your bills, and the problems pile up.

It’s fine to work on your prepping before you have a perfect money foundation. You can start buying the basics from an emergency preparedness checklist while also starting to pay down your debt and build an emergency savings fund in parallel. Just keep things in balance and use your head.

- Build a rainy day emergency fund

- Why you must start now

- Why you should pay off your debt quickly

- Pay yourself first

- Even if you hate budgeting, at least look at your expenses

- How to budget for the real world

- Stop wasting money and change how you think of happiness

- How to invest wisely & retirement accounts

- Why you should avoid financial advisors

- Learn more

Build a three or six month emergency fund

There’s a million very realistic reasons you should always have a few months worth of money set aside for a rainy day:

- job loss

- car accident

- parking ticket

- medical problem

- flying to a sudden funeral

- buying supplies before a major storm

- your crazy uncle needs bail

- and on, and on…

Besides actually having the money when you need it, this has huge positive effects on your mental and physical health. You’ll sleep better knowing that when life problems inevitably arise you’ll be able to handle them without it turning into a major crisis.

That peace of mind is priceless.

If money is tight, start small. Get to a month, then take a break and celebrate. Then get to three months. Then six.

You often hear these described as “three month funds.” Modern experts are now recommending six months, partly because of how much longer it’s taking some people to find a job in our broken economy and our reduced social safety nets.

To keep things clean and simple, your emergency fund should be separate from any retirement and normal savings accounts.

One of the sane prepper rules is that great preps are always ready. At any given moment you should know that your bug out bag is packed and ready to go — otherwise it’s a lot less valuable.

The same is true for your emergency fund: you must treat that money as a special vault you can’t open unless it’s an actual emergency. It’s not a piggy bank to casually borrow from when you’ve gone over your budget due to bad choices. You’ll inevitably forget or be unable to refill it, and of course an emergency will strike at the worst time.

Eventually, you can grow and diversify this emergency fund to include cash and precious metals you keep in your home and emergency kits to use when SHTF.

There’s also a potential role for bitcoin and other cryptocurrencies in a prepper’s emergency fund. Crypto is a risky gamble and shouldn’t be more than a small piece of your money. But it can be a good way to protect yourself against economic and geopolitical risks.

The rest of this article covers how to manage your money and reach these goals.

Start now

It can’t be said enough: start now.

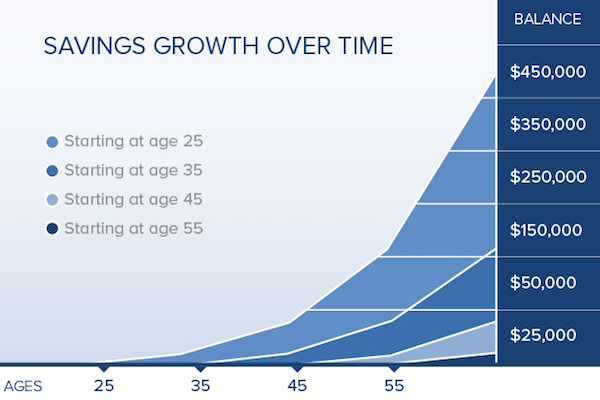

Because of how money works — namely the snowballing effect of compound interest and investment rewards — each year you wait to work on your finances costs you a big penalty down the road.

Even if you save the same amount of money each month, your savings don’t grow in a straight line. Compare two scenarios:

- Starting at 25 years old, for the next 10 years you put $3,000 a year into a retirement account. Then you stop saving after 35 years old and don’t add another dime until you retire at 65.

- You don’t start saving until you’re 35. You invest $3,000 a year, every year, from 35 until retiring at 65.

You will have more money at 65 in the first scenario than in the second — around $340,000 compared to $300,000 — even though you saved the same amount per year for only 10 years in the first scenario compared to 30 years in the second. The difference is how early you began.

Get out of the debt trap and improve your credit score

Debt can be a good thing when used appropriately — like a fixed home mortgage that’s appropriate for your earning level — but most personal debt is toxic in practice.

Credit cards, student loans, car loans, payday loans, and so on have created a form of modern slavery that keeps people trapped. If you’re in debt, you probably feel the same way most people do: It seems like a hopeless, never-ending, uphill battle.

Even if you do succeed at climbing your way out of the debt hole, it forever puts you at a disadvantage because of the time you wasted giving other people interest instead of making it yourself and snowballing.

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” — Albert Einstein

You can’t change the past, but you can change the future. Yes, it’s very hard, but we’ve never seen a single person who regretted biting the bullet and paying off their debt.

It’s such a no-brainer that most financial experts recommend paying down your debts as the first thing you should do in almost any scenario.

It doesn’t matter if you only have $20 left after your core expenses each month or if you just got a pile of surprise cash through an inheritance or tax refund. The best return on investment for most people is to lower their high-interest debt before doing anything else.

To understand why, you have to understand compound interest.

The average American with a credit card balance carries $16,000 in debt at a 17% interest rate.

Imagine you totally stop using that credit card for new purchases and you tighten your belt to budget a whole $500 a month to pay it down.

Because of compound interest, which keeps the clock running every day/month you owe someone else money while the interest snowballs on itself, in that scenario you’d pay a whopping $5,500 in interest on top of the $16,000 and it would take 43 months to complete.

Similar to the idea that “a penny saved is a penny earned”, any interest you don’t have to pay is basically the same as earning that amount of money.

So instead of giving your credit card company a 17% annual return on their investment (the loan they made to you), by paying that debt off and avoiding their 17% interest, you’re effectively “investing” that payoff payment and getting a 17% return for yourself!

Compare that to most of the common investments available to you (like the stock market and real estate) which usually generate around 7-8% returns every year.

So if you have high-interest debt, and you have some money to spend/invest, using that money to pay down the debt is two or three times as good of a decision as putting it into the stock market — and it’s an infinitely better decision than wasting it on more garbage you don’t need.

Tip: You can usually refinance your debt, which is similar to refinancing a home mortgage. We recommend Lending Club and have used it for years.

You get one new loan that pays off your existing credit cards. The new loan has a lower interest rate (perhaps 11% instead of 17%), so you save a lot of money over time. And it’s easier to make one payment instead of multiple.

Continuing the $16,000 example above, taking 1-2 hours to refinance your CC’s could lower the lifetime interest payments from $5,500 to just $3,000! Two grand for two hours of work sounds great, right?

Tip: Don’t pay for your own credit reports. Get them for free from your credit card company, Credit Karma, or through the free (once per year) Annual Credit Report site. But be careful: There are a ton of rip-off services that try to charge you for the reports of extra services like identity theft protection.

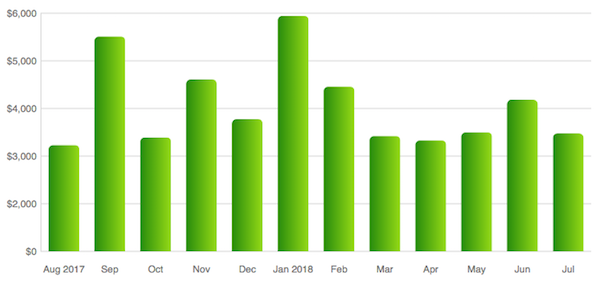

Pay yourself first

What is more important to you and your family: You or Verizon? You or Starbucks? Healthcare or the newest iPhone?

Money is value. When you spend money, you’re essentially deciding what you do and don’t value in life.

For the 99% of us who have a limited amount of money to spend each month, the order of what you spend money on represents the ranking of what you value most. If you always pay your 300-channel TV bill first but only put money into your retirement account if there happens to be some left over at the end of the budget/month, you’re essentially saying your future is less important than watching Keeping Up with the Kardashians.

You and your future — and all the bonuses that come from a healthy financial foundation like emergency preparedness and family happiness — is more important than anything else.

So you must show yourself and your family what you truly value by paying yourself first!

Paying yourself first means when you get your paycheck, the first bill you pay is your own personal bill. It’s one of the best modern money management hacks for average people, and we strongly recommend it.

Think of it like paying an invoice from Your Future Self Inc, who charges you a percentage of your take-home pay. For example, you get your paycheck for $4,000, and the first thing you do is send $500 of that over to your retirement/savings account or rainy-day fund so that you don’t spend any of it in the short term.

A common target is 20%, but it ranges from 5 to 30%. If budgets are tight, start with 5% this year and go to 10% next year. It’s more important that you build the habit than what the numbers are in the beginning.

Tip: Use automatic transfers so you don’t forget or break the rules. If you know you get paid twice a month on the same days, set it up so that 10% of your paycheck is automatically transferred to your special savings account a day after the income arrives. That way when you look at your normal account, you’re already seeing the money left over after paying yourself first.

What about debt? The previous advice about paying down high-interest debt is still true. You’re still paying yourself first in the sense that you’re prioritizing your personal finances over anything else — you’re just sending that money to pay off debt first because it’s the right thing to do. Once the debt is down you can save for retirement, vacation, etc.

Just look at your expenses

When you measure something, you tend to pay more attention to it and things get better.

Research shows, for example, that if you step on the scale every morning you are more likely to make good diet choices during the day. No diets, no calorie counting, no overwhelming programs that are too hard to stick with — simply by weighing yourself each morning, you subconsciously make better little decisions along the way.

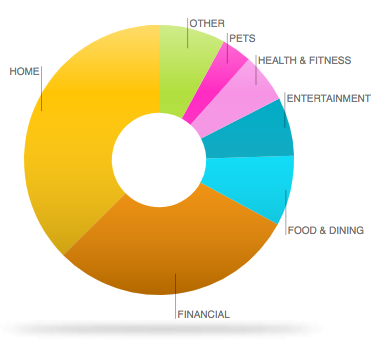

The same is true in finance. Even if you absolutely hate budgeting, which is equivalent to calorie counting and diets in the example above, everyone should spend at least five minutes every month looking at how they’ve spent their money. That’s it — just look.

You might notice a monthly subscription service you forgot to turn off. Or you’ll realize just how much you’re wasting on Starbucks or cigarettes.

Tip: You can simply look at your detailed credit card statements, or use free software like Mint that automatically tracks and categorizes your spending. Your bank might offer the same features in their web app, too, but you shouldn’t pay for it.

Create a simple budget and stick to it

Budgets are like diets — most people hate them and don’t stick with it. But, also like diets, budgeting is a tried-and-true way to keep yourself on track and there’s no shortcut around it.

Continuing from the pay yourself first model above, a good rule of thumb is the 50-30-20 budget:

- 50% is for “needs” (like housing and healthcare)

- 30% is for “wants” (like eating out or new clothes)

- 20% of your budget is to pay yourself first (like retirement or debt payments)

Let’s walk through a “reverse budgeting” example:

- Your take home pay is $5,000 per month.

- Paying yourself first at 20% means $1,000 automatically goes into long-term savings or to pay down debt.

- 50% for your core needs leaves $2,500, and you can’t spend more than that.

- Perhaps those core needs are $1,200 for rent, $400 for eat-at-home food, $350 for medical, $300 for utilities/internet/mobile, $100 car payment, $50 gas, $50 car insurance, and $50 renters insurance.

- That leaves you a maximum of $1,500 to spend on things you don’t need to live: Netflix, fashionable clothing, the new iPhone, soccer dues for the kids, movies, beer, eating out, whatever.

Not only does this grow your savings and prevent you from wasting too much money on things you don’t need, it can guide important decisions that people often get wrong.

For example, the 2008 Global Financial Crisis was partly caused by people buying houses that were too expensive for their budget. Lenders were breaking the traditional rules of thumb and allowing people to take on a mortgage that represented large chunks (e.g. 50%) of their income each month, not the 24% of income in the example above ($1,200/$5,000). That left no room for error, causing too many people to default on their payments, lose their home, and crash the markets.

So when you’re thinking about “how much house should I buy?”, “what car should I get?”, or “where should we go on holiday?”, you must think about it in these terms.

Tip: If you struggle with budgeting, think it’s dull, or get frustrated with rigid math that doesn’t adapt with daily life, then check out the very popular You Need A Budget. We particularly like the “safe to spend” feature that quickly tells you how much fun money you have left to spend this month.

Prepping tip: Once you’ve got your financial house in order, you can create a special budget item/goal for prepping. Perhaps you set aside $50 or $100 a month to put towards new gear or skills. Think of it like an insurance payment… because it is!

Buy less junk and change how you think about happiness

You’re probably bad at spending money. Not that it’s hard to actually spend the money — it’s just hard to spend it well.

How much of what you spend is simply to keep up appearances so you don’t feel like a loser among your friends? How much do you spend to plug spiritual holes in yourself that can’t actually be filled with temporary crap?

“We buy things we don’t need with money we don’t have to impress people we don’t like.” — Dave Ramsey, personal finance icon

The intersection of money and happiness is very well studied. For example, once an average American makes more than about $70,000 per year, their happiness stops directly increasing with more money. Someone who makes $200,000 is usually just as happy as someone who makes $70,000.

There is a mountain of data that says the more you buy, the less happiness you feel. Each new thing gives you less and less happiness value.

Then, much like a drug habit, you have to keep chasing the next high, even though each high is weaker and shorter.

Psychologists call it the hedonic treadmill because you’re running further and faster but not really getting anywhere.

So get off the treadmill and reconsider what makes you happy and why you buy the things you do.

Reject consumerism. It’s a cultural poison. Study after study shows that relationships and experiences are much more fulfilling than stuff anyway.

We’re not suggesting you become a poor hippy living in a van. We enjoy a small number of high-quality products that actually improve our lives. But we’ve personally experienced the life-changing value of being more intentional about what we buy and getting rid of all the junk that drags us down.

Prepper tip: Spend money on prepping experiences, like a ham radio course or a survival medicine training class in your area. You’ll feel better than sitting on the couch, learn valuable skills, and make meaningful connections!

Tip: If you haven’t used something you own in the last 12 months, get rid of it! We’ve done the minimalist “100 things” challenge and enjoyed it for both daily life reasons and to be better preppers.

More: Be More With Less and Stop Spending Money to Impress People

How to invest wisely

It’s a lot easier than you think! Investing well can obviously delve into a deep topic (see “learn more” at the end of this article), but these core ideas will help any average person succeed.

Once you’ve covered the money basics described above (like paying down debt and having an emergency fund), you don’t want to leave too much cash sitting idle in bank accounts that earn you almost nothing. Put that money to work so it makes you even more money instead — in other words, make compound interest work for you!

If you have $10,000 in a savings account, it will pay you a horrible average of $6 per year in interest. But that same $10,000 put into the stock market or similar investments will create an average of $700-$800 per year.

Being lazy is a good thing

You don’t need to follow boring business news or read dry accounting reports. And unless you’re an expert, don’t bother trying to “pick winners”, whether picking stocks or picking a house to buy and flip.

A great personal stock portfolio is one that you spend a few hours on once or twice a year. That’s it!

Imagine you have $10,000 to invest. Which do you think is a better long-term investment strategy: Going into casinos on your own to play the slots versus passively owning a piece of the casino itself?

Clearly owning a piece of the casino is better. But extrapolate that idea even further — owning a small piece of every single public company in the world is a great idea because instead of guessing if company X or company Y will win, you’re simply betting that the economy will grow overall.

Which, at least for the last few hundred years, has been an extremely safe and extremely profitable bet to make.

Note: Yes, this is a little ironic because many intelligent preppers believe the economy won’t continue to do well the next few decades. History does not always repeat itself. How you adjust your investing based on this fear is an advanced topic for another article.

It’s easy to buy every stock in the US or around the world with just one purchase: Total Market Index Funds. You buy one bucket and it has a little piece of everything in it.

Even wealthy and sophisticated investors use the very popular Three Fund Lazy Portfolio:

- An index fund that covers the entire US stock market

- An index fund that covers the entire non-US stock market

- An index fund that covers the entire bond market (which are lower-risk-lower-reward than stocks)

The portfolio mix between them depends on your age and risk tolerance, but you could imagine 50% US stocks, 30% foreign stocks, and 20% bonds. The closer you are to retirement, the more you move money from riskier bets like stocks into safer bets like bonds.

Tip: We strongly recommend using Vanguard to manage your stocks and retirement accounts. They created the entire market of index investing, have the lowest fees, and now manage over $5 trillion dollars.

Max out your retirement accounts

The idea that the government or a company pension will cover you is a pipe dream. US Social Security is expected to fail in 2034 and many private pensions have already failed. Part of the reason is that we now have more retirees than young workers, so there’s not enough new money coming in.

So the government offers incentives to encourage people to save for themselves. You are leaving a large amount of free and easy money on the table if you have the ability to put money into a retirement account, but don’t.

Many people have 401k retirement plans available through their work. Some employers even match your contributions, so if you put $5,000 of your salary into the 401k, the company puts another $5,000 in. That’s free money. Take it!

You’ll also save money in the short term. Depending on which types of retirement accounts you use, you typically have a lower tax bill the year you invested the money because that money isn’t part of your taxable income. So instead of paying taxes on $45,000 in income, if you invested $5,000 in a “pre-tax” account (like an IRA), you’d only pay income taxes against $40,000. Plus that $5,000 continues to grow, tax free, until you pull it back out.

Tip: There are rules on what you can do and limits to how much money you can put in each year. Just try to do the maximum whenever you can.

More: Talk with your HR department or read more online. We suggest checking out Individual Retirement Accounts (IRAs), post-tax Roth IRAs, and Health Savings Accounts as well.

Advanced tip: If you’re already doing the basics in retirement accounts, check out backdoor and mega backdoor Roth IRAs and how to use an HSA as a fake Roth IRA.

Avoid financial advisors

40% of Americans use a financial advisor. But the data and experts are clear: They are almost never worth it.

In fact, advisors can cost an average person millions of dollars over their lifetime, yet they perform worse than monkeys and cats picking investments at random. There are almost no regulations or qualifications to be an advisor (or “wealth manager”, “retirement planner”, etc.).

Most of them are glorified sales people who are not required to act in your best interest. Their motivation is to make money off you. One of the classic ways they do this is by recommending investments that give the advisor a kickback commission. Or if it’s an advisor who’s employed by a bank, their job is to get you to put money into products their own bank sells.

The only exception are advisors who are fiduciaries. That means they are legally required to act in your best interest.

Only 1.6% of financial advisors in the US are fiduciaries with no other conflict of interest! The government is considering new laws in this area to protect people, but it’s going sideways.

If you ever do work with someone trying to influence how you manage your money, you must ask them directly if they are a fiduciary. Do not work with them if the answer is anything but a simple “yes!”

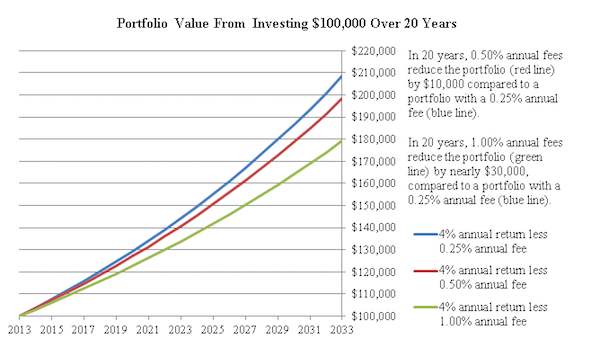

You should almost never pay for financial advice that takes their fee as a percentage of your assets (usually 0.5-1.0%). Work with fee-only advisors who charge you based on their time.

Learn more

This guide is just the 80-20 basics. Spend just a few hours this year learning more about money management — a little bit of effort will likely make a huge difference in your future wallet. It’s one of the only opportunities in life where you can earn $1,000 per hour of effort.

We like:

- Bogleheads Wiki and Bogleheads Forum — from the founder of Vanguard, the best investment management company on the planet

- Reddit /PersonalFinance — another great forum

- Mr. Money Mustache — easy to understand advice under the “retire early” umbrella

- Dave Ramsey — just ignore the promotional stuff

- Michael Kitces — for advanced readers

- The Richest Man in Babylon — a great and free ebook

- The Millionaire Next Door — a great book that talks about the concepts of living below your means, how to build real wealth, rejecting consumerism, etc.