Millions of Americans have received stimulus payments from the CARES Act, but many still haven’t. Here’s who’s eligible:

- US citizens, permanent residents, and qualifying resident aliens…

- …who aren’t claimed as dependents on another tax return…

- …have a valid Social Security Number, unless one half of a married couple is in the armed forces…

- …and whose adjusted gross income isn’t over $99,000 for a single filer, $136,500 for a head of household, or $198,000 for joint filers.

If you’re eligible, you’re generally due $1200 ($2400 for joint filers) and $500 for each qualifying child. However, if you make over $75,000 as an individual, $112,000 as a head of household, or $150,000 as a married couple, your payment is reduced by $5 for each $100 over that amount. Those income numbers are based on your 2018 and 2019 tax returns.

However, you don’t have to have income to be eligible for the payment, but if you’re not required to file taxes, you may have to apply for your stimulus money.

If you draw Social Security, retirement, disability, survivor benefits, Supplemental Security Income, Veterans Affairs benefits, or Railroad Retirement and Survivor Benefits, your payment should be automatic. However, if you receive those benefits and have an eligible dependent child, you should apply to get the extra $500 per child.

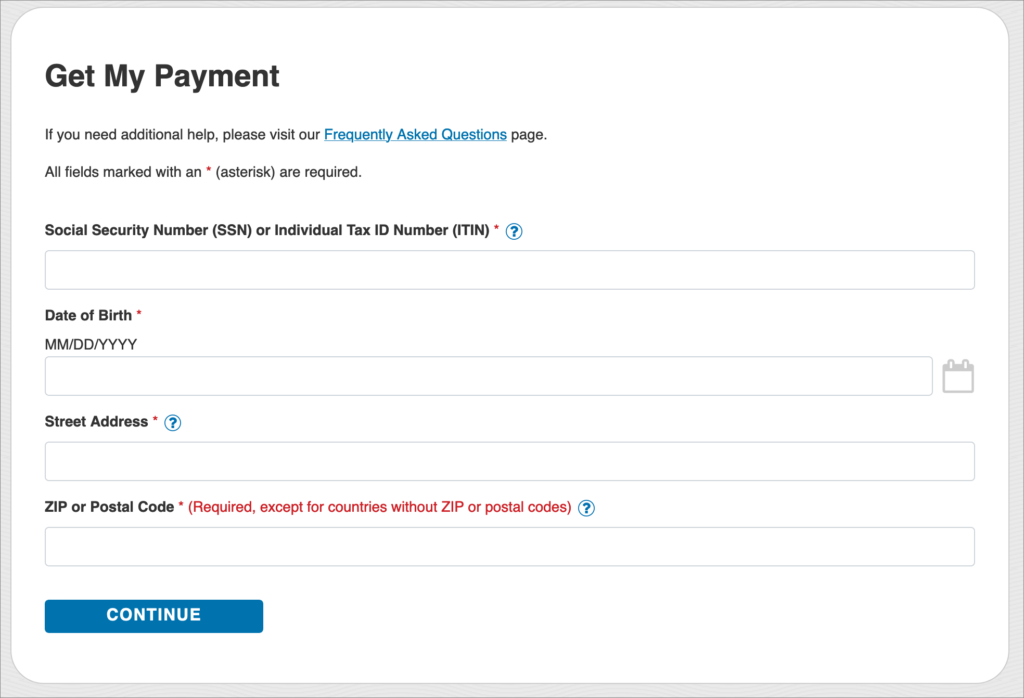

If you filed taxes in 2018 or 2019 and either paid an amount owed or received a refund through direct deposit, you should have already received your payment. But if you haven’t, the IRS has a tool to check its status.

However, I and many others have found this tool to be rather persnickety. It couldn’t find my payment status when I tried to look it up. A friend couldn’t look up his payment until he entered his most recent refund amount as zero.

If you’re having problems with the tool, then unfortunately there’s not much you can do to get help. As the IRS states: “Due to our efforts to protect IRS employees, taxpayers and our stakeholders, extremely limited services are currently available. The IRS is unable to process paper tax returns, respond to paper correspondence or staff toll-free live service lines.”

If you’re owed a check instead of direct deposit, you could be waiting for up to 20 weeks. The IRS will send it to your last-known address, based on your tax returns. If that’s changed in the past couple of years, you’ll either have to update your address through the US Postal Service or file a 2019 tax return with your updated address.

You are reporting the comment """ by on